Bill didn't feel he had the expertise to share new insights on the FTX affair. Never stopped me.

FTX is nothing short of corporate malfeasance in a poorly regulated industry, and since Bill had posted, Sam Bankman-Fried was arrested and charged with fraud and conspiracy. The whole affair has rippled through the cryptocurrency ecosphere and will likely lead to a much higher regulatory framework than the industry was hoping for.

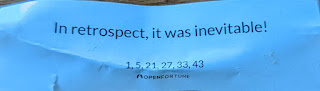

Cryptocurrencies have had an interesting 2022 starting with the Superbowl ads Bill was rallying against. FTX even sponsored baseball umpires, sports arenas and fortune cookies including this prescient one

Those were in the glory times of FinTech, i.e. early 2022. Even before FTX had its problems, we had the Three Arrows Capital bankruptcy and the TerraUSD stablecoin collapse. Bitcoin lost over 60% of its value during the year.

Of all the problems we've seen with cryptocurrency, it's never because of the crypto. I'm still shocked how the person or people called Satoshi Nakamoto got it mostly right on the first try. They did fail to account for the energy needed to mine bitcoin once bitcoin became valuable, but on the other hand who could have predicted bitcoin would become so valuable. Certainly not me.

I still don't see much of a market for most cryptocurrencies beyond speculation and illegal activities, though we have much of both. Nevertheless it feels weird in 2022 that we still use physical bills and coins. I am hopeful for a CBDC (Central Bank Digital Currency), not a stablecoin tied to a dollar, but US currency itself just in digital form.

We now use digital tickets for most events and transport. Even driver's licenses and passports are moving digital--they only gets scanned anyway. There are a few remaining uses of paper--property titles, legal wills, social security cards, birth, death, marriage and divorce certificates. Perhaps we could use blockchain or even centralized databases to eliminate these as well.

Blockchain could also be helpful to track our digital goods, so we can use the music, movies, books, games, virtual clothes and accoutrements on different platforms without having to buy them twice. (HT Siva)

The most important use of FinTech will be for those who have the least, those who pay large fees to have a bank account, cash a paycheck or send money to family overseas. FinTech can be a great democratizing tool, if we use it that way and not just as another get rich scheme.

This technocratic vision of the world only applies to the elite.

ReplyDeleteSomething like 45+% of New York City doesn't even have a basic bank checking account let alone smart phones, etc.

Now take into account India and China and suddenly you realize that you're just a minority within a minority.

In any case, the original usage of bitcoin was precisely to eliminate the large fees to transfer money overseas. That it got taken over for nefarious purposes is unfortunate.

Also, you should note that the blockchain ledger is just basically the same as the original proof that NP=PCP[O(log n), O(1)].

If you didn't see that, shame on you!

Other developed countries do not use coins and notes any more. Here in Australia, for example, almost all transactions are done with a credit card (or smartphone) tap and go. Crypto not required. The few notes in my wallet grow mouldy. I only carry a coin to use as a ball marker on the putting green.

ReplyDeleteJapan is gloriously bimodal about this. Cell phones, apple watches, credit/debit cards, "chargeable IC cards" (mainly the Suica card whose original/main purpose was prepayment of train/subway fares (this functionality is now available in cell phones, so most people just tap their cell phone to get into/out of the subways/commuter trains, which provide 36 million rides every single day in Tokyo)) are now widely accepted in stores and taxis. Even vending machines work with the Suica card: select your drink, tap the card on the panel, and out comes the drink. There's no need for cash, but cash is accepted everywhere as well. Apparently the credit card charges to stores are painfully stiff: I just upgraded my camera to the latest model, and despite a generous trade-in allowance on the old one and some lenses, it still required 30 pieces of paper handed over in a brown envelope. (The store had previously mentioned that they preferred cash, and I checked again, and they said yes, thank you. And this was after not even blinking at being handed that much cash; the salesperson just counted it as though this was a normal thing she did several time a day.)

DeleteAnon1, where do your numbers come from? I would be shocked if 45% of people in NYC do not have cellphones, since it seems to be something that even poor people make a priority (more people probably have cellphones than can pay their heating bill, for example).

ReplyDeleteMy biggest issue with eliminating paper is the "rewriting of history" that is all too easy when things are only in digital form. When things are digital either I have to rely on devices whose software and hardware I have to trust for a long period of time or I have to rely on other powerful entities like banks not to alter them or get hacked or simply remove my ability to see the data. (This has happened enough in my experience for me to be wary.)

ReplyDeleteBlockchain definitely has the potential to eliminate that rewriting of history. OTH the tradeoff in environmental costs vs paper is still a bit unclear.

"There are a few remaining uses of paper--property titles, legal wills, social security cards, birth, death, marriage and divorce certificates."

ReplyDeleteMy impression is that many of those (e.g. property titles) are already digital, in the sense that it's the entry in the locality's database that means you own the property. You might need a paper birth certificate, but you get that by persuading your birth locality to print out an entry in their database. It's certainly seemed to be that way in both Boston and Tokyo for a long time now. (Wills might be still paper. One family I knew realized that the will in question (a) didn't reflect the mutually agreed desires of the heirs and (b) would have been an inheritance tax disaster, so they got togerther, openned the will, read it, agreed on the above, and burned it. Paper has it's problems, too.) In retrospect, it was worth the effort, but when I applied for my Japanese government retirement benefits, I had to get my name written exactly the same way in every database I appear in (banks, health insurance, etc.) and that was the hardest part of the process...

Anyway, my impression is that crypto/blockchain is a solution in search of a problem. But that may be my innate cynicism showing through...

Sorry to be beating a dead horse, but it turns out Bitcoin itself has imploded. Or at least is having problems.

ReplyDeletehttps://arstechnica.com/information-technology/2023/01/key-bitcoin-developer-calls-on-fbi-to-recover-3-6m-in-digital-coin/?comments=1

For people, such as myself, who aren't exactly enamored of this idea, this is a Shadenfreude festival of epic proportions....